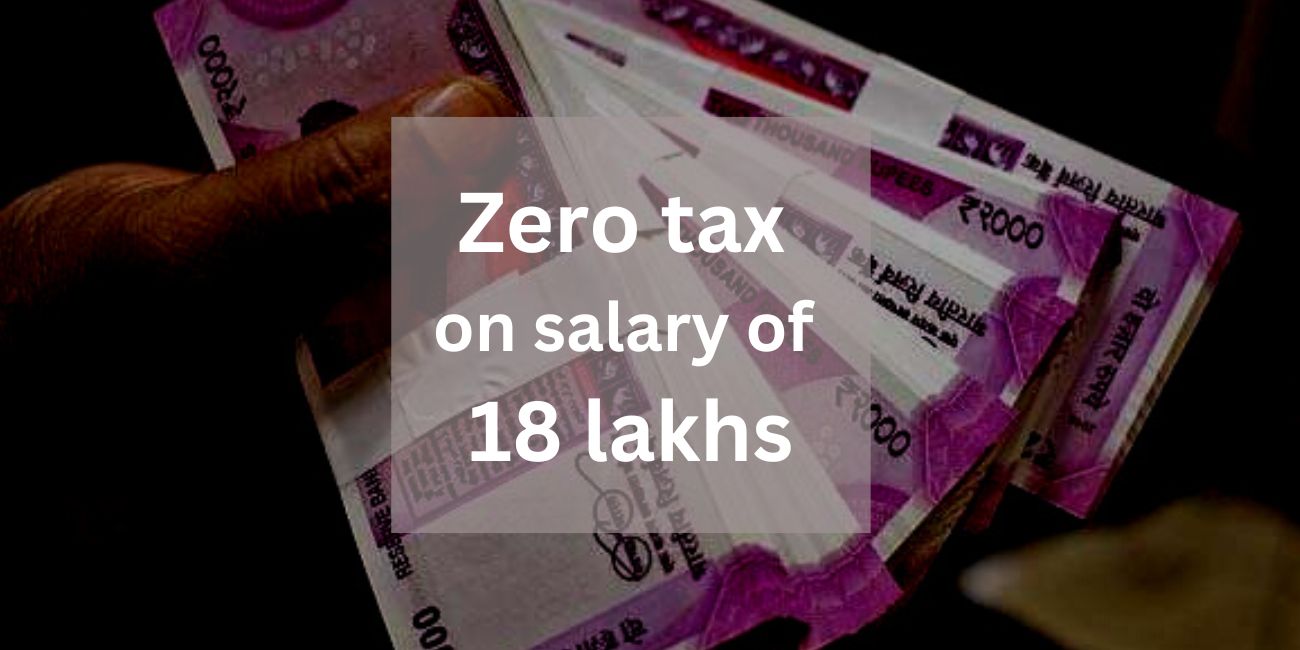

As the 2023 financial year approaches, now is the perfect time to start thinking about tax planning. By taking advantage of tax-saving opportunities, you can potentially reduce your tax burden and keep more of your hard-earned money in your pocket. Here are 5 tax saving tips for the 2023 financial year:

- Contribute to a retirement account. In India, contributions to certain retirement accounts, such as the Public Provident Fund (PPF) and the National Pension System (NPS), are eligible for tax deductions. By contributing to one of these accounts, you can lower your taxable income and potentially save on taxes.

- Take advantage of tax deductions and credits. The Indian tax code offers a number of deductions and credits that can help reduce your tax burden. For example, you may be able to claim deductions for charitable donations, education expenses, and medical expenses. It’s important to review the available deductions and credits and take advantage of those that apply to your situation.

- Invest in tax-efficient investments. Some investments, such as tax-free bonds and certain types of mutual funds, offer tax benefits. By investing in these types of instruments, you can potentially lower your tax bill.

- Review your tax withholding. If you are an employee, you can adjust the amount of tax withheld from your paychecks by submitting a new Form 12BB to your employer. By doing this, you can ensure that you are having the right amount of tax withheld and avoid owing taxes or getting a large refund when you file your return.

- Hire a tax professional. Tax laws can be complex, and it can be helpful to work with a tax professional to ensure that you are taking advantage of all available tax-saving opportunities. A tax professional can also help you navigate the tax code and avoid mistakes that could lead to penalties or other issues.

By following these tax saving tips for the 2023 financial year, you can potentially reduce your tax burden and keep more of your hard-earned money. Remember, however, that tax laws are subject to change, and it’s important to stay up-to-date on the latest developments and seek professional advice when needed.