Introduction

National Highways Authority of India (NHAI) bonds have long been recognized as a stable investment option, offering investors the opportunity to earn attractive returns while contributing to the development of critical infrastructure projects in India. However, recent developments have shed new light on the returns offered by NHAI bonds, particularly with the introduction of the National Highways Infra Trust (NHAI InvIT) bonds.

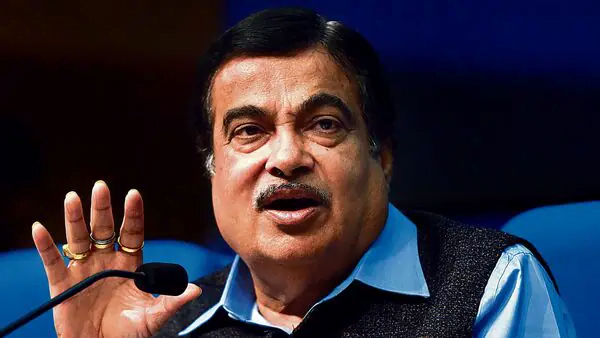

In a recent announcement, Union Minister for Road, Transport and Highways, Nitin Gadkari, revealed plans to open NHAI InvIT bonds every 15 days, offering interest rates of up to 8.50 per cent. This marks a significant development in the landscape of NHAI bonds, providing investors with an even more lucrative investment opportunity.

According to Minister Gadkari, the NHAI InvIT bonds were launched at the Mumbai Stock Exchange, initially intended for a 10-day period. However, the overwhelming response from investors led to the bonds being oversubscribed seven times over within just seven hours of their launch. This unprecedented demand underscores the strong investor appetite for infrastructure investment opportunities in India.

The NHAI InvIT bonds now offer an attractive interest rate of 8.50 per cent per year, providing investors with the potential for stable and substantial returns on their investment. Additionally, a scheme has been introduced wherein investors can receive monthly interest payments directly deposited into their accounts, with a minimum investment requirement as low as ₹10,000.

These developments highlight the government’s commitment to mobilizing funds for infrastructure development through innovative financial instruments. The NHAI InvIT bonds not only offer investors an avenue for earning attractive returns but also play a crucial role in supporting India’s infrastructure growth trajectory.

With the introduction of the NHAI InvIT bonds and the enhanced returns they offer, investors now have an even more compelling reason to consider NHAI bonds as part of their investment portfolio. As always, investors are advised to conduct thorough research, assess their investment objectives and risk tolerance, and stay updated on the latest developments in the market to make informed investment decisions.

Understanding NHAI Bonds Returns:

NHAI bonds are debt instruments issued by the National Highways Authority of India to raise funds for infrastructure development projects, particularly in the highways and road sector. These bonds typically offer fixed returns to investors in the form of periodic interest payments (coupon payments) and the return of the principal amount at maturity.

Factors Influencing NHAI Bonds Returns:

- Coupon Rate: The coupon rate is the annual interest rate paid by NHAI on its bonds. Higher coupon rates translate to higher returns for investors.

- Maturity Period: The maturity period of NHAI bonds determines the duration over which investors receive interest payments. Generally, longer maturity periods may offer higher returns but come with higher risk.

- Interest Payment Frequency: NHAI bonds may offer different interest payment frequencies, such as annual, semi-annual, or quarterly. More frequent interest payments result in higher annualized returns.

- Market Conditions: Prevailing market conditions, including interest rate movements, inflation rates, and investor demand, can influence NHAI bond prices and consequently affect returns.

- Credit Rating: NHAI bonds are assigned credit ratings by rating agencies based on their creditworthiness. Bonds with higher credit ratings typically offer lower returns but come with lower risk.

Types of NHAI Bonds:

NHAI issues different types of bonds to cater to the diverse needs of investors. These may include:

- NHAI 54 EC Capital Gains Bonds: These bonds are issued by the National Highways Authority of India (NHAI) under Section 54EC of the Income Tax Act, 1961. They are specifically designed for investors looking to save capital gains tax by reinvesting the proceeds from the sale of a capital asset into these bonds within a specified period. NHAI 54 EC bonds typically have a lock-in period of three years and offer fixed returns of 5.25%. It’s important to remember that the interest earned on these bonds is subject to income tax. They are a popular choice among investors seeking tax-saving opportunities while earning stable returns. 54EC bonds have the highest safety rating (“AAA”) and are issued by central PSUs, ensuring no repayment or interest risk.

- Bharatmala Bonds: Bharatmala is a flagship infrastructure development program initiated by the Government of India to enhance road connectivity across the country. Bharatmala Bonds, while not launched yet and still in the draft phase, are expected to be issued by NHAI as part of financing the Bharatmala project. These bonds are anticipated to attract investors interested in contributing to India’s infrastructure development while earning returns on their investments. However, until officially launched and details are finalized, investors will need to stay updated on developments regarding Bharatmala Bonds.

Calculating NHAI Bonds Returns:

The returns from NHAI bonds can be calculated using the following formula:

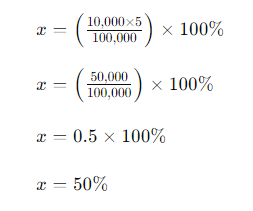

For e.g.

– Annual Interest Payment : ₹10,000

– Number of Years: 5 years

– Initial Investment: ₹100,000

Using the formula:

So, based on these assumptions, your total return from the NHAI bond investment would be 50%.

This formula helps investors gauge the total returns from their NHAI bond investment, taking into account the annual interest payment, duration of holding, and initial investment amount.

Conclusion

NHAI bonds stand out as a lucrative investment option, offering investors the potential for stable returns and a sense of security backed by the government. Through fixed-rate coupon payments and the possibility of capital appreciation, NHAI bonds provide an avenue for investors to earn steady income while contributing to the development of crucial infrastructure projects in India.

The consistent coupon payments from NHAI bonds serve as a reliable source of income, providing investors with regular cash flow at predetermined intervals. Moreover, the potential for capital appreciation adds an element of growth to the investment, offering the opportunity for investors to benefit from increases in bond prices over time.

While NHAI bonds present attractive returns, it’s essential for investors to conduct thorough research and assess their investment objectives and risk tolerance before making investment decisions. Understanding the factors influencing NHAI bond returns, such as prevailing interest rates, market conditions, and bond terms, is crucial for making informed investment choices.

In conclusion, NHAI bonds offer a compelling combination of stability, income, and growth potential, making them a valuable addition to any investor’s portfolio. By carefully evaluating the risks and rewards associated with NHAI bonds and seeking guidance from financial experts, investors can harness the full potential of NHAI bonds to achieve their financial goals and objectives.

Frequently Asked Questions (FAQ) - Returns from NHAI Bonds

NHAI bonds are debt securities issued by the National Highways Authority of India to raise funds for infrastructure projects. They generate returns through fixed-rate coupon payments and potential capital appreciation.

NHAI bonds typically pay interest semi-annually or annually, with the coupon rate determined at the time of issuance. Coupon payments are calculated based on the face value of the bond and the coupon rate.

While NHAI bonds are considered relatively secure investments due to the government backing, returns are not guaranteed. Factors such as changes in interest rates, market conditions, and credit ratings can affect bond returns.

NHAI bonds may experience capital appreciation if their market value increases over time. Factors such as declining interest rates or increased demand for the bonds can lead to higher bond prices and potential capital gains for investors.

NHAI bonds may be taxable or tax-exempt depending on the specific bond issue and the investor’s tax status. It’s essential to consult with a tax advisor to understand the tax implications of investing in NHAI bonds.

Yes, investors can reinvest the returns from NHAI bonds to compound their earnings over time. Reinvesting coupon payments or capital gains can accelerate wealth accumulation and enhance overall returns.

Potential returns from NHAI bonds can be calculated by considering the coupon rate, investment amount, holding period, and potential capital appreciation. Investors can use financial calculators or consult with financial advisors to perform these calculations.

While NHAI bonds offer relatively stable returns, investors should be aware of risks such as interest rate risk, credit risk, and liquidity risk. Understanding these risks is essential for making informed investment decisions.