Introduction:

Insurance serves as a safety net for individuals and businesses, providing financial protection against unforeseen events. However, some individuals attempt to exploit this system by filing false insurance claims, jeopardizing the integrity of the insurance industry. In India, the repercussions for engaging in such deceptive practices are severe. This comprehensive blog om “False Insurance Claim Punishments in India” will delve into the nuances of false insurance claims, the legal framework in India, and the punishments associated with this unlawful act.

Understanding False Insurance Claims:

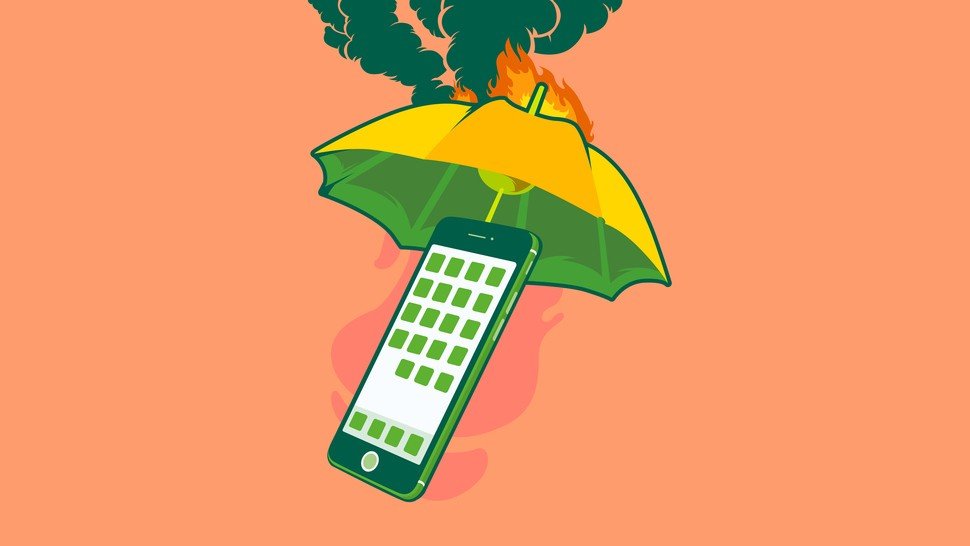

A false insurance claim occurs when an individual intentionally provides misleading or fraudulent information to an insurance company in order to receive undeserved benefits. This can involve exaggerating losses, staging accidents, or providing false documentation. Such deceptive practices not only harm the insurance company but also contribute to increased premiums for honest policyholders.

Legal Framework in India: False Insurance Claim Punishment in India

In India, false insurance claims are addressed under various laws and regulations. The Insurance Regulatory and Development Authority of India (IRDAI) plays a pivotal role in regulating and overseeing the insurance sector. Additionally, the Indian Penal Code (IPC) and the Insurance Act, 1938, contain provisions that deal with fraudulent insurance claims.

Punishments for False Insurance Claims in India:

Civil Penalties:

- Monetary Damages: Insurance companies have the right to pursue civil action against individuals filing false claims. This may involve recovering the amount paid out, along with additional damages.

- Policy Cancellation: Insurance companies can cancel the policy of the individual who filed a false claim. This can have long-term consequences, making it challenging for the individual to secure insurance in the future.

Criminal Penalties:

- Imprisonment: Under the IPC, individuals found guilty of insurance fraud can face imprisonment. The duration of imprisonment may vary depending on the severity of the offense.

- Fine: In addition to imprisonment, the court may impose fines on those convicted of filing false insurance claims.

IRDAI’s Role:

- Regulatory Actions: The IRDAI has the authority to take regulatory actions against insurance intermediaries or companies involved in promoting fraudulent activities. This can include penalties, suspension, or revocation of licenses.

Collaboration with Law Enforcement:

- The insurance industry often collaborates with law enforcement agencies to investigate and prosecute cases of insurance fraud. This joint effort aims to deter fraudulent activities and ensure that perpetrators face legal consequences.

Public Awareness Campaigns:

- To prevent false insurance claims, regulatory bodies and insurance companies conduct public awareness campaigns. These initiatives educate the public about the consequences of insurance fraud and emphasize the importance of honesty in insurance dealings.

Examples of Insurance Frauds and Punishments

| Fraud Type | Description | Punishments |

|---|---|---|

| 1. Staged Accidents | Deliberately causing an accident to make a false claim for damages and injuries. | Imprisonment, Fines, Policy Cancellation |

| 2. Exaggerated Losses | Inflating the value of lost or damaged property to claim a higher insurance payout. | Monetary Damages, Policy Cancellation |

| 3. False Injury Claims | Claiming injuries that did not occur or exaggerating the extent of actual injuries. | Imprisonment, Fines, Policy Cancellation |

| 4. Arson for Insurance | Intentionally setting fire to property to collect insurance money for the damages. | Imprisonment, Fines, Policy Cancellation |

| 5. Identity Fraud | Using false identities to secure insurance policies or make claims under someone else's policy. | Imprisonment, Fines, Policy Cancellation |

| 6. Premium Evasion | Providing false information to insurers to secure lower premiums than warranted. | Monetary Damages, Policy Cancellation |

| 7. Fake Documentation | Submitting forged documents to support an insurance claim. | Imprisonment, Fines, Policy Cancellation |

| 8. Concealing Material Facts | Withholding important information that could affect the insurer's decision to provide coverage. | Monetary Damages, Policy Cancellation |

Conclusion:

False insurance claims pose a significant threat to the insurance industry and can have far-reaching consequences for both insurers and policyholders. The legal framework in India is robust, with stringent penalties in place to deter individuals from engaging in deceptive practices. It is crucial for the public to be aware of these consequences and for insurers to continue implementing measures to detect and prevent fraudulent activities. By fostering a culture of honesty and integrity, India can maintain the trust and reliability of its insurance sector.

A false insurance claim occurs when an individual intentionally provides misleading or fraudulent information to an insurance company with the aim of receiving undeserved benefits. This can include exaggerating losses, staging accidents, or providing false documentation.

False insurance claims are addressed under various laws and regulations in India. The Insurance Regulatory and Development Authority of India (IRDAI) oversees the insurance sector, while the Indian Penal Code (IPC) and the Insurance Act, 1938, contain provisions dealing with fraudulent insurance claims.

Civil penalties for false insurance claims may include monetary damages, where the insurance company can recover the amount paid out along with additional damages. Additionally, policy cancellation is a common consequence, making it challenging for the individual to secure insurance in the future.

Yes, criminal penalties may include imprisonment and fines. The duration of imprisonment may vary based on the severity of the offense. The court may impose fines as an additional punishment for those convicted of filing false insurance claims.

The IRDAI plays a crucial role in regulating and overseeing the insurance sector in India. It has the authority to take regulatory actions against insurance intermediaries or companies involved in promoting fraudulent activities. This can include penalties, suspension, or revocation of licenses.

Insurers often collaborate with law enforcement agencies to investigate and prosecute cases of insurance fraud. This joint effort aims to deter fraudulent activities and ensure that perpetrators face legal consequences for their actions.

Yes, regulatory bodies and insurance companies conduct public awareness campaigns to educate the public about the consequences of insurance fraud. These initiatives emphasize the importance of honesty in insurance dealings and help deter individuals from engaging in deceptive practices.

Yes, individuals found guilty of insurance fraud may face both civil and criminal penalties. Civil penalties may include monetary damages and policy cancellation, while criminal penalties may involve imprisonment and fines.

The public can contribute to preventing insurance fraud by being vigilant and reporting any suspicious activities to the relevant authorities. Additionally, staying informed about the consequences of insurance fraud through public awareness campaigns can help foster a culture of honesty and integrity.

If individuals suspect insurance fraud, they should report their concerns to the insurance company and relevant authorities. Reporting such activities can contribute to the prevention and prosecution of fraudulent claims, ultimately preserving the integrity of the insurance industry.