Introduction

In the fast-paced world of today, owning a car has become more of a necessity than a luxury. As we hit the roads daily, navigating through unpredictable traffic and potential hazards, safeguarding our vehicles becomes paramount. While traditional car insurance policies offer protection against unforeseen events, the advantages of zero depreciation car insurance stand out as a game-changer in the realm of vehicle coverage.

Understanding Zero Depreciation Car Insurance

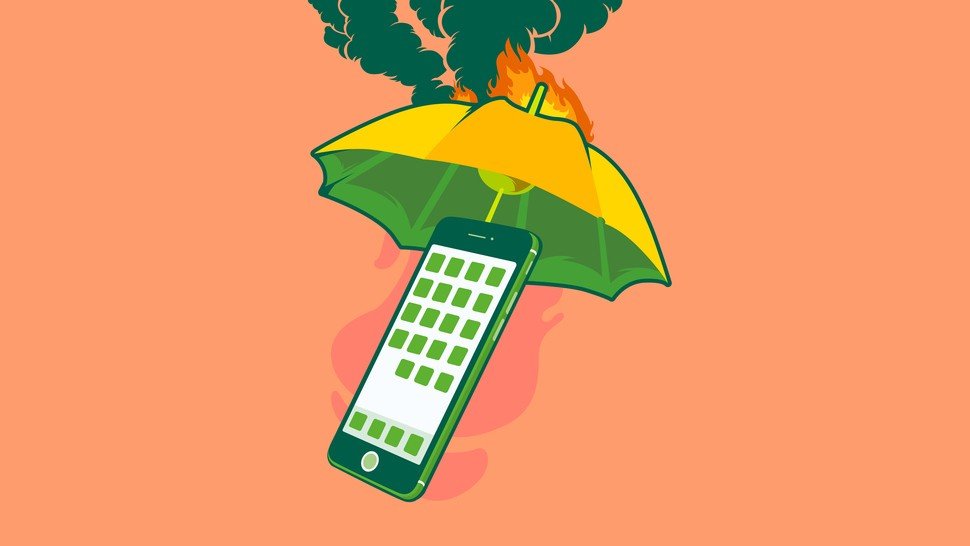

Zero depreciation, also known as ‘bumper-to-bumper’ or ‘nil depreciation’ insurance, is an enhanced form of coverage that goes beyond the limitations of standard insurance policies. Unlike regular plans, zero depreciation insurance accounts for the depreciating value of your car over time, ensuring that you receive the maximum compensation without factoring in depreciation during a claim.

Key Advantages of Zero Depreciation Car Insurance

Full Claim Settlement:

- Traditional insurance policies deduct depreciation from the claim amount, leaving you with a significantly reduced sum. With zero depreciation insurance, you receive the entire cost of repairs or replacement without any deduction for depreciation.

Cost-Efficient Repairs:

- In the event of an accident, the cost of repairing or replacing damaged parts can escalate rapidly. Zero depreciation insurance provides a cost-effective solution by covering the full value of parts, including those prone to high rates of depreciation, such as plastic, fiber, and rubber components.

Ideal for New Cars:

- Zero depreciation insurance is particularly advantageous for new car owners. In the initial years, the rate of depreciation is higher, and traditional insurance policies may not cover the full cost of repairs or replacement. Opting for zero depreciation coverage ensures that you don’t bear the brunt of the depreciation during a claim.

Peace of Mind:

- Knowing that your insurance covers the entire cost of repairs without factoring in depreciation offers peace of mind. This advantage is especially valuable in situations where the repair costs are high, ensuring that you don’t face financial strain during unexpected events.

Frequent Claimants Benefit:

- For individuals who make frequent claims, zero depreciation insurance proves to be a cost-effective choice. The cumulative savings from multiple claims can offset the slightly higher premium associated with this coverage.

Conclusion

In the dynamic landscape of car insurance, where every penny saved matters, zero depreciation insurance emerges as a strategic choice for comprehensive coverage. The advantages of zero depreciation car insurance are undeniable, providing full claim settlement, cost-efficient repairs, and peace of mind for car owners. As you navigate the roads with your prized possession, consider the long-term benefits of zero depreciation insurance – an investment that ensures your vehicle remains as valuable on paper as it is in your life.

Faq Related "Advantage of Zero Depreciation Car Insurance"

Zero depreciation car insurance, also known as ‘nil depreciation’ or ‘bumper-to-bumper’ insurance, is an enhanced coverage option that provides full compensation for repairs or replacement of car parts without factoring in depreciation. It ensures that you receive the entire claim amount without any deduction for the depreciating value of the vehicle.

Unlike traditional car insurance policies that factor in depreciation during claim settlements, zero depreciation insurance covers the entire cost of repairs or replacement without considering the depreciating value of the vehicle. It is a more comprehensive and cost-effective option, especially for new cars and frequent claimants.

While zero depreciation insurance is highly beneficial for new cars, it is also a valuable option for used cars. The coverage ensures that all eligible parts, regardless of their depreciation rate, are fully covered during a claim, providing peace of mind to car owners of all vehicle ages.

Yes, zero depreciation insurance typically comes with a slightly higher premium compared to standard insurance policies. However, the increased premium is often outweighed by the cost savings during claim settlements, making it a financially prudent choice, especially for those who make frequent claims.

While zero depreciation insurance offers extensive coverage, it may have certain limitations. These may include restrictions on the number of claims allowed in a policy term or specific conditions for coverage. It’s essential to review the policy terms and conditions to understand any limitations associated with the coverage.

Yes, many insurance providers allow policyholders to add zero depreciation coverage as an add-on or rider to their existing insurance policy. This can be done during the policy renewal or purchase process. Adding zero depreciation coverage enhances the overall protection provided by the insurance policy.

Zero depreciation insurance typically covers all parts of the car, including those prone to higher rates of depreciation, such as plastic, fiber, and rubber components. However, it’s crucial to review the policy documents to understand the specific inclusions and exclusions related to the coverage.

Assessing whether zero depreciation insurance is suitable for you depends on factors such as the age of your car, your driving habits, and your willingness to pay a slightly higher premium. If you prioritize comprehensive coverage and want to avoid out-of-pocket expenses during claims, zero depreciation insurance is likely a beneficial choice.